SERBIA ADOPTS NATIONAL ENERGY AND CLIMATE PLAN

In July 2024 the Serbian Government adopted the Integrated National Energy and Climate Plan (INECP) for the period until 2030, with projections extending to 2050. This plan aims to significantly boost the share of renewable energy in the country’s electricity mix, targeting 45% from renewable sources by 2030.

The article explains the main features of the Plan, its implementation and its impact on renewable energy investments, sources of renewable energy finance, subsidies and incentives available to private investors from Serbia or abroad.

This and other analyses of investments in renewable energy sources arose as a necessity due to our involvement in some projects in financing and sale of renewable energy sources in Serbia. We have decided to share part of our analysis publicly with all of you. In another article we looked at the Law on Use of Renewable Energy Sources as the legal framework that regulates this area.

Key features of the Plan

Key highlights of the Plan include:

- Investments in Renewables: Around 3.5 GW of new solar and wind power capacity is expected to be added by 2030.

- Greenhouse Gas Emissions: The plan aims to cut greenhouse gas emissions by 40.3% compared to 1990 levels.

- Internal energy market: Development of a competitive and integrated energy market that enables the free flow of energy and increases transparency.

- Energy security: Ensuring stable and secure energy supply through diversification of energy sources and modernization of energy infrastructure.

- Energy Efficiency: There will be intensive investments in increasing energy efficiency across all sectors.

- Environmental Protection: The plan aligns with European decarbonization standards and aims to upgrade environmental protection.

- Research, innovation and competitiveness: Encouraging research and innovation in the field of energy and climate change in order to increase the competitiveness and sustainability of the energy sector. The Serbian Government has signed memoranda with over 20 research and development institutions who will work on the implementation of the Plan.

This strategic move is expected to enhance power supply security, increase the use of clean energy, and contribute to environmental sustainability.

Serbia’s current energy mix

Serbia’s energy mix is primarily dominated by fossil fuels, but there is a growing emphasis on renewable energy sources. Here’s an overview of the current energy mix:

- Fossil Fuels:

- Coal: Coal is the largest component, accounting for about 45% of the total energy supply.

- Oil: Oil contributes around 24%.

- Natural Gas: Natural gas makes up approximately 15%.

- Renewable Energy:

- Hydropower: Hydropower is the most significant renewable source, contributing a substantial portion of the renewable energy mix.

- Wind and Solar: Wind and solar energy are growing sectors, with wind energy contributing around 27% of the renewable capacity.

- Bioenergy: Bioenergy also plays a role, making up about 13% of the renewable energy consumption.

- Electricity Generation::

- The state-owned utility EPS (Elektroprivreda Srbije) owns the majority of the installed capacity, including thermal power plants and hydro power plants.

- Independent Power Producers (IPPs) contribute to the renewable energy capacity with wind, solar PV, and other sources.

- Energy Transition Goals:

- Serbia aims to increase the share of renewable energy in its total energy consumption, with targets set for the coming decades.

This energy mix reflects Serbia’s ongoing efforts to balance its reliance on fossil fuels with the development of renewable energy sources, aligning with global trends towards sustainability and environmental protection.

Challenges to implementation of the Plan

With such energy mix, implementation of the Plan comes with several challenges:

- Dependence on Fossil Fuels: Despite the push for renewables, Serbia still relies heavily on fossil fuels, particularly coal. Transitioning away from coal and other fossil fuels while ensuring energy security is a significant hurdle.

- Investment and Funding: Achieving the ambitious targets for renewable energy and energy efficiency requires substantial investments. Securing the necessary funding and attracting private investments can be challenging.

- Infrastructure and Technology: Upgrading the existing energy infrastructure to accommodate new renewable energy sources and improving energy efficiency across sectors will require advanced technology and significant infrastructural changes.

- Regulatory and Policy Framework: Developing and implementing effective policies and regulations that support the INECP goals, including emissions trading systems and carbon taxes, is complex and requires careful planning.

- Public and Stakeholder Engagement: Ensuring public support and engaging various stakeholders, including industries, NGOs, and local communities, is crucial for the successful implementation of the plan.

Since we are a financial consulting firm, our focus is on the sources and modes of financing renewable sources of energy and this is what we will discuss in furhter details below.

Sources of funding

The projects under the Plan are funded through a combination of sources:

- European Union (EU) Funding: The development of the INECP itself is part of a project funded by the EU, with an initial investment of EUR 900,000.

- International financial institutions: EBRD, IFC, World Bank, GIZ and other institutions provide technical assistance as well as financial support, directly or indirectly through the local commecial banks.

- Public Sector Investments: The Serbian government has allocated significant funds for these projects. The total investment needs for the public sector are estimated at around EUR 10.72 billion until 2030.

- Commercial banks: the role of commercial banks is essential for mobilising local savings into financing the renewable energy sources as well as functioning as a conduit to channel the funds from the international financial institutions.

- Private Investments: Attracting private sector investments is also a key component. The cumulative investment needs, including private sector contributions, are projected to reach EUR 27.41 billion by 2030. Serbia tries to attract both local and international investors to commit to investing in renewable energy sources. Areas for investment include:

- Solar power plants,

- Wind power plants,

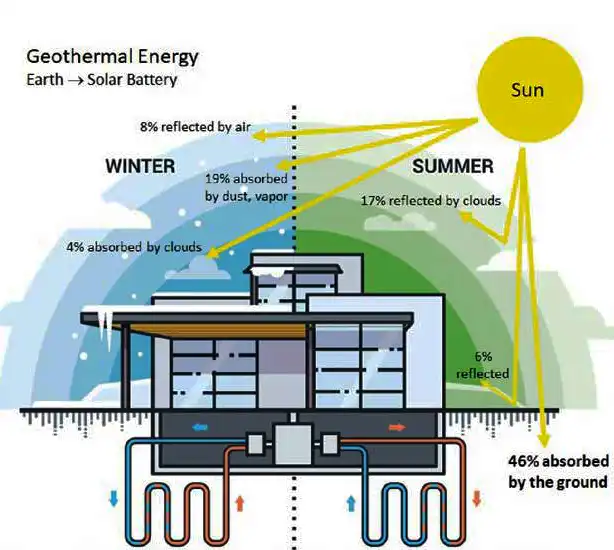

- Geothermal energy-in a rush for investment in solar and wind power plants, this source of energy is somehow overlooked. The investment opportunities are:

- Residential construction for heating and cooling individual residential buildings with any number of residential units. This firm advises and is raising funds for a residential project of 950 residential units which all will be heated and cooled by a close loop vertical geothermal energy system. Thera are possibilities for use of the open loop geothermal energy, for example such system has alrady been applied in residential buildings in New Belgrade,

- Remote district heating-the Government is investing in installation of heat exchange pumps (open loop system) in a number of cities which will use either heating underground water (Bogatic, for example) or a river (City of Nis) or for public buildings such as the new Coach station located in New Belgrade which will use abundance of underground water for heating and cooling,

- Electricity production-in certain places with the hot underground water, it is possible to construct electricity production facilities, for example Vranjska Banja.

These funding sources are crucial for ensuring the successful implementation of the INECP and achieving its ambitious goals.

International sources of funding

There are several notable case studies of successful bank-funded green projects in Serbia:

- Green for Growth Fund and UniCredit Bank Serbia: In February 2024, the Green for Growth Fund (GGF) provided a €50 million loan to UniCredit Bank Serbia to finance utility-scale renewable energy projects, focusing on solar and wind energy. This initiative is expected to save 400,000 MWh of primary energy annually and reduce CO2 emissions by 132,000 tons per year.

- Green, Livable, Resilient Cities Program: Initiated by the World Bank in June 2021, this program aims to strengthen sustainable and resilient urban development in select Serbian cities. The program focuses on enhancing green infrastructure, improving energy efficiency, and promoting sustainable urban planning.

- Scaling-Up Green Finance for MSMEs: A study co-financed by the EU and the UNDP highlights the role of commercial banks and international financial institutions in supporting green projects for micro, small, and medium-sized enterprises (MSMEs) in Serbia. This includes providing long-term loans, guarantees, grants, and technical assistance to ensure the success of green investments.

These case studies demonstrate the significant impact of bank-funded initiatives on promoting renewable energy and sustainable development in Serbia.

Incentives and subsidies

Serbia offers several incentives to encourage private investments in green energy:

- Subsidies and Grants: The government provides subsidies for up to 65% of funds invested in energy efficiency measures in private households. This includes investments in insulation, new windows, and biomass boilers.

- Auction-Based Subsidies: The new law on renewable energy use includes auction-based subsidies, such as market premiums and feed-in tariffs, to support renewable energy projects. These incentives are designed to make investments in wind, solar, and other renewable energy sources more attractive.

- Corporate Power Purchase Agreements (PPAs): These agreements allow private companies to enter into long-term contracts to purchase renewable energy directly from producers, providing a stable revenue stream for investors.

- Tax Incentives: There are various tax incentives for companies investing in renewable energy projects, including reduced taxes and exemptions.

- International Funding and Support: International financial institutions, such as the European Bank for Reconstruction and Development (EBRD), provide loans and technical assistance to support green projects. The EU also co-finances projects aimed at enhancing energy efficiency and renewable energy adoption.

These incentives are part of Serbia’s broader strategy to transition to a more sustainable and green economy.

Role of commercial banks

Banks play a crucial role in financing renewable energy projects in Serbia through various mechanisms:

- Providing Loans: Banks like UniCredit Bank Serbia offer substantial loans specifically for renewable energy projects. For instance, the Green for Growth Fund (GGF) recently provided a €50 million loan to UniCredit Bank Serbia to finance utility-scale solar and wind projects1.

- Technical Assistance: Banks often provide technical support to renewable energy developers. This includes assistance with due diligence, construction monitoring, and ensuring projects meet technical and environmental standards1.

- De-risking Mechanisms: Financial institutions use de-risking mechanisms to make green investments more attractive. This can include guarantees, insurance, and other financial instruments that reduce the risk for investors2.

- Partnerships with International Financial Institutions (IFIs): Banks collaborate with IFIs like the European Bank for Reconstruction and Development (EBRD) to secure additional funding and support for green projects. The EBRD, for example, has invested significantly in Serbia’s energy efficiency and clean energy sectors3.

- Promoting Green Finance: Banks are key players in promoting green finance by offering specialized financial products and services that support sustainable investments. This includes green bonds, sustainability-linked loans, and other innovative financing solutions4.

These efforts by banks are essential in driving the transition to a more sustainable energy sector in Serbia.

However, the implementation of bank-funded green projects in Serbia is not plain sailing and has its hurdles and challenges:

- Lack of Long-Term Commitment: Many commercial banks in Serbia lack a long-term commitment to financing green projects. They often perceive these investments as unprofitable and risky.

- Capacity and Expertise: There is a shortage of skills and expertise within banks to assess and implement green projects effectively. This includes a lack of knowledge about green technologies and funding opportunities1.

- Regulatory and Legal Barriers: Complicated legal procedures and regulatory frameworks can hinder the smooth implementation of green projects. Navigating these complexities requires significant time and resources.

- Funding and Financial Instruments: Securing adequate funding remains a challenge. While there are various financial instruments available, accessing them can be difficult for smaller enterprises and projects.

- Public Awareness and Engagement: Ensuring public support and engagement is crucial. There is often a lack of awareness and understanding among the general public and stakeholders about the benefits and importance of green projects.

- Environmental and Technical Challenges: Projects often face environmental and technical challenges, such as site selection for renewable energy installations and integrating new technologies into existing infrastructure.

Addressing these challenges requires a concerted effort from banks, government, and other stakeholders to create a more supportive environment for investments in renewable energy.

Several commercial banks in Serbia have been recognized for their support for the financing of renewable energy projects:

These banks provide significant support to private investors through favourable credit conditions, technical assistance and cooperation with international financial institutions.

Our assistance for investment in renewable energy projects in Serbia

Financial consultants in Serbia play a key role in supporting private investors in securing financial resources, investment capital and loans for renewable energy projects. Here is how we can help:

- Preparation of documentation: Consultants assist in the preparation of all necessary documentation for applying for loans, including business plans, feasibility studies and financial analyses.

- Capital structuring: They help in defining the optimal capital structure for financing the project, minimizing the financial participation of investors and maximizing the return on invested capital.

- Access to financial sources: Consultants have a network of contacts with banks and non-banking financial institutions, which facilitates access to favourable loans and investments.

- Consulting and support: They provide consulting services throughout the entire process, from the initial idea to the realization of the project, including assistance in negotiations with financial institutions.

- Risk Management: Help identify and manage risks associated with renewable energy projects, thereby increasing the likelihood of project success.

These services can significantly facilitate the process of financing and implementation of renewable energy projects, reducing risks and increasing the chances of success.

Our projects offer

- If you are looking for a small scale renewable energy project, please consider our offer for a company that has a construction land of 5,2ha and an approval for design and connection a solar power plant to the power grid (colloquially known as the “grid connection approval”) WITHOUT having to install power battery storage equipment.

- If you are looking for a large scale renewable energy project, please contact us to consider your investment requirements.

Further details

Please contact Zoran Mitic by email or by tel +381 11 36 35 935 or mobile tel +381 63 377 960 for more information about opportunities in the renewable energy or fill out the contact form below.