SERBIA ACHIEVES INVESTMENT CREDIT RATING

In July 2024 The Serbian Government adopted the Integrated National Energy and Climate Plan (INECP) for the period until 2030, with projections extending to 2050. This plan aims to significantly boost the share of renewable energy in the country’s electricity mix, targeting 45% from renewable sources by 2030.

The article explains the main features of the Plan, its implementation and its impact on renewable energy investments, sources of renewable energy finance, subsidies and insetives available to private investors from Serbia or abroad.

Main details:

- Previous rating: BB+ (stable outlook)

- New rating: BBB- (stable outlook)

- Date of upgrade: 4th October 2024

- Outlook: Stable

The key factors that influenced S&P’s decision to upgrade Serbia to an investment credit rating were:

- Strong economic performance

- Improved fiscal metrics

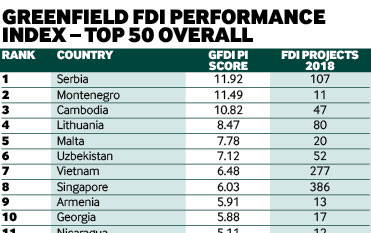

- Enhanced investor confidence

- Strategic reforms and stability

The new BBB- rating is expected to have significant impacts on the Serbian economy and foreign direct investment (FDI). Other major credit rating agencies such as Fitch and Moody's are likely to follow suit with their next Serbia’s credit rating appraisal further solidifying its improving financial reputation. We will further analyse this tectonic shift for Serbia and its possible impact for the real economy and for real estate and hospitality investments in separate article which will publish over the next few days.