POST FINANCIAL CRISIS REAL ESTATE FINANCE IN SERBIA

The financial crisis that started in 2008 had a profound impact on the real estate market in Serbia and changed it for good. The market become more competitive, about 50% of developers or investors active pre 2008 are gone off the market never to return. Instead, new, manly corporate or institutional investors appeared on the scene. The bank financed almost dried up, banks adopted conservative lending policy, which lately has been relaxed to a degree. The investors have available new financial instruments for financing ever more complex and more expensive real estate development projects. As Serbia has been approaching EU, successive governments worked hard on improving legal environment for real estate development, cutting red tape and simplifying administrative procedures for developers.

The financial crisis and its impact on the Serbian real estate market

Globally, the financial crisis has significantly changed the way real estate have been financed over the last 6-7 years. During the first years of the crisis, bank loans as traditional source of finance almost dried up or became very expensive. Many real estate developers and construction companies were severely affected by lack of finance on one hand and lack of demand for their products on the other hand. We all witnessed some spectacular failures of both the financial institutions heavily involved in real estate sector or property developing moguls. Distressed assets mounted up. Private sector investors (REITs, PERE funds, mezzanine funds etc) tried to fill up the gap left after the banks’ withdrawal from it.

The real estate market in Serbia went through a similar pattern. The crisis was not so severe but it lasted longer. This year we are likely to see more steady signs of real estate market recovery.

Residential market

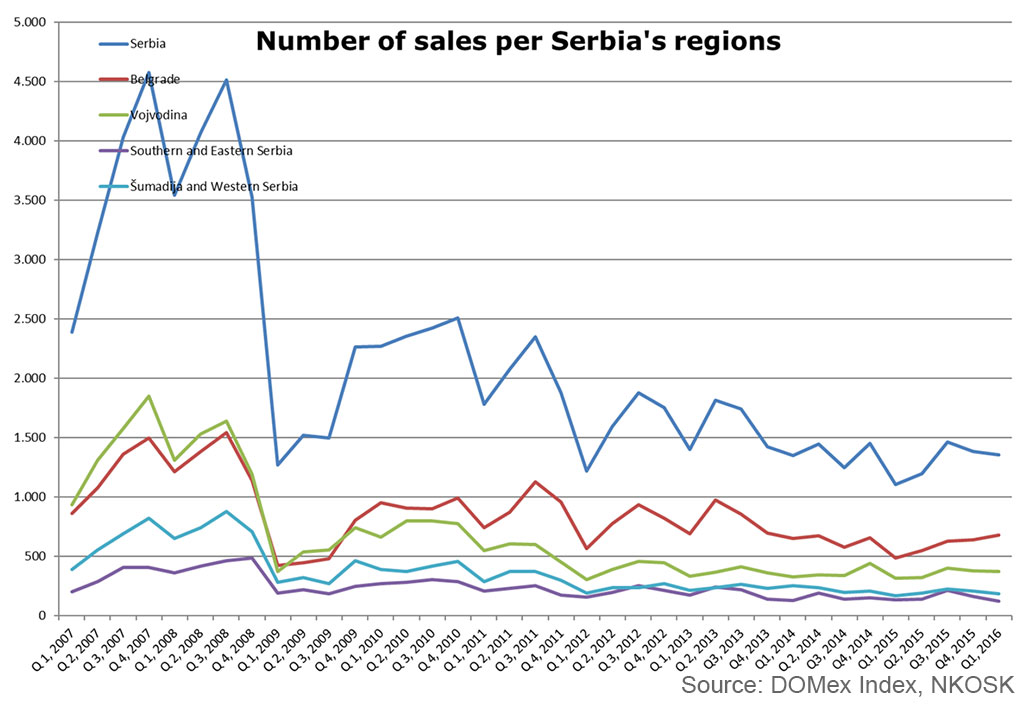

According to the data compiled by the National Corporation for mortgage underwriting (Nacionalna korporacija za osiguranje kredita- NKOSK), sales of residential units in Q4 2008 of 4,578 fell to 1,103 in Q1 2015 before it recovered to 1.367 sales in Q1 2016.

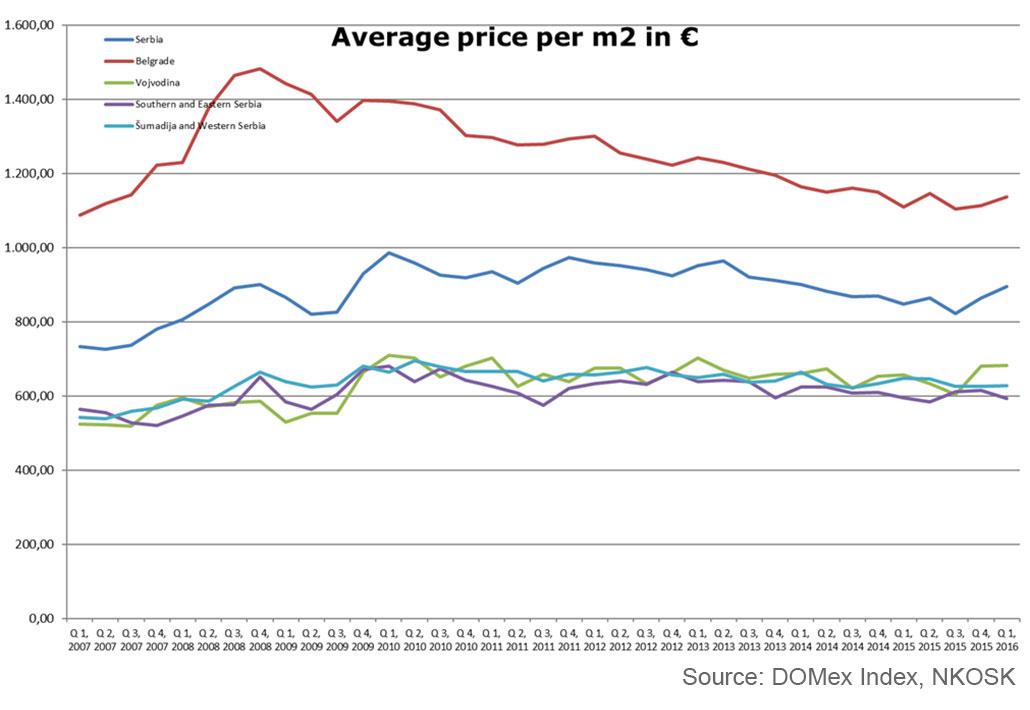

Sale prices per square meter also fell. The average price of residential space in Belgrade in Q4 2008 was €1,482, it went down to €1,109 in Q1 2015 since when it was on the path of steady recovery to €1,137 in Q1 2016. The largest price volatility was in Belgrade, while the Vojvodina region experienced the least price volatility movements.

Commercial real estate

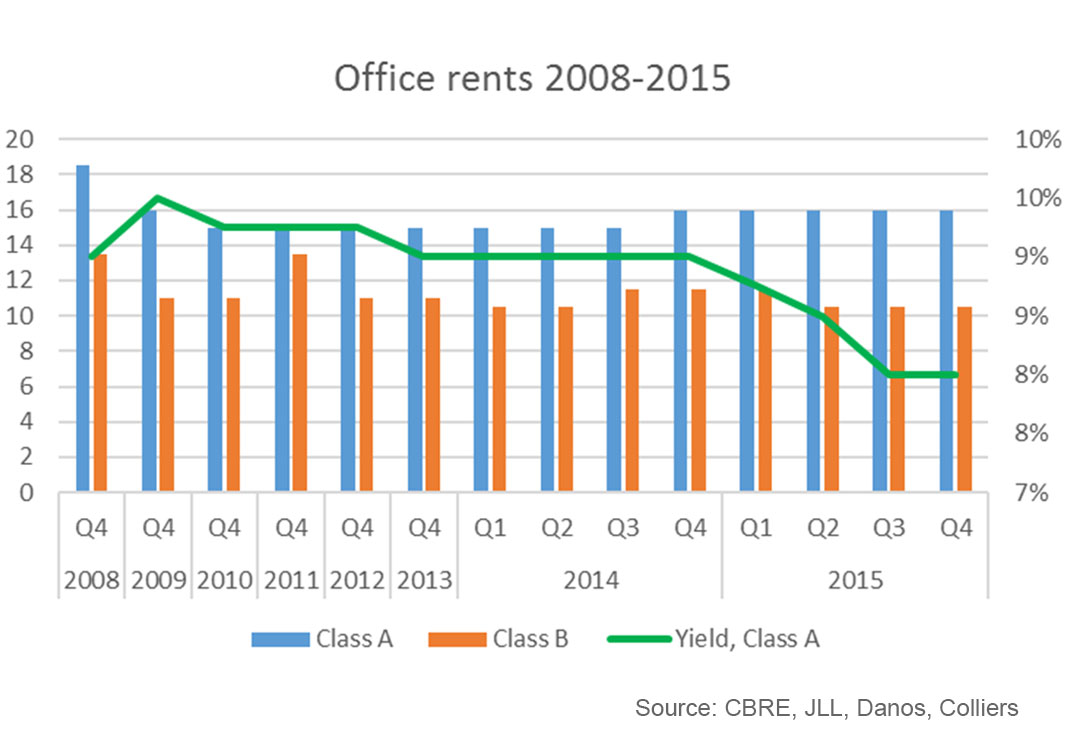

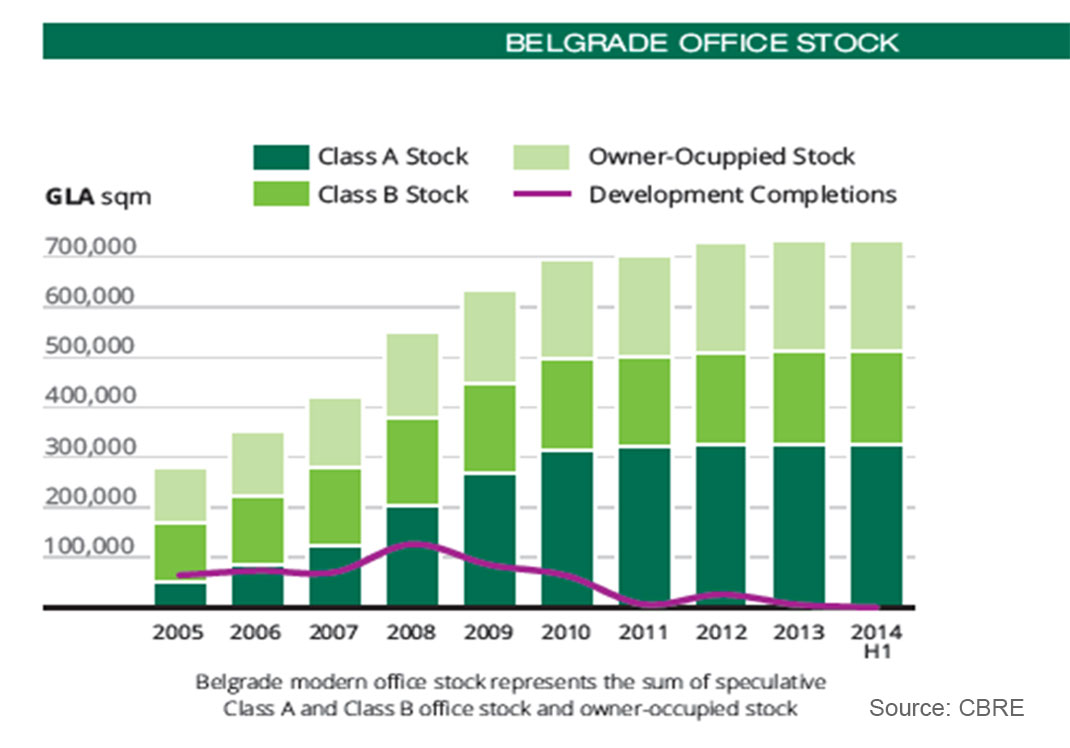

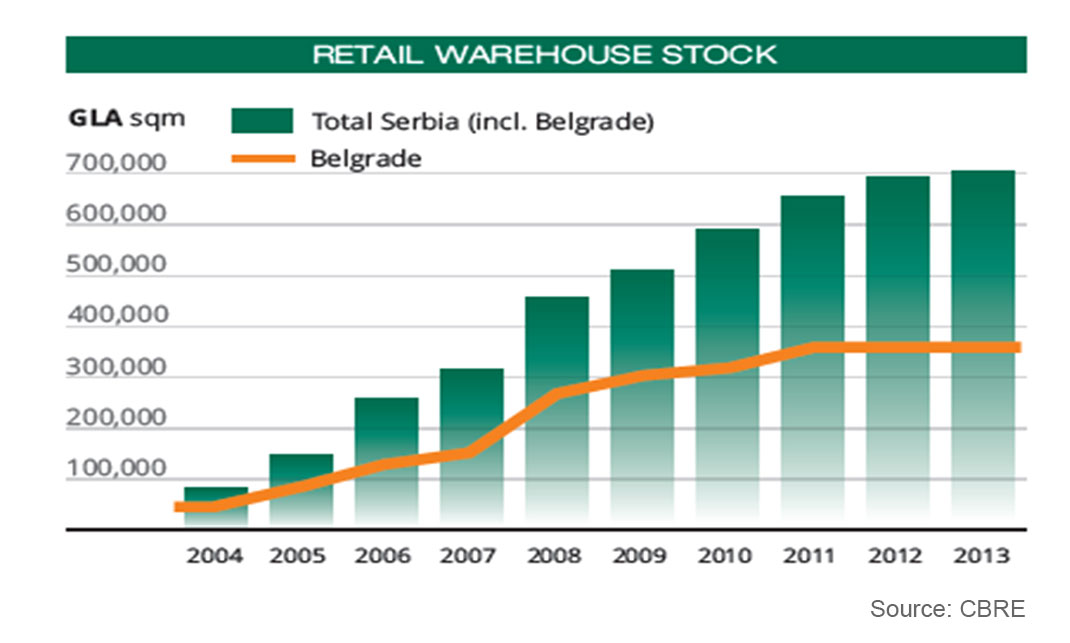

Retail and office space was more resilient to the financial crisis. Thus, prime office rents at its peak of €17-20 (average value €18,5) per m2 per month in Q4 2008 went down to the average rent of €15 per m2 per month in Q4 2010 and remained unchanged until Q4 2014 when it recovered to €16 per m2 per month on average. During this period GLA increased by about 200,000 m2. Yields declined from their peak of 9.25% during 2009-2011 to about 8% where they are today.

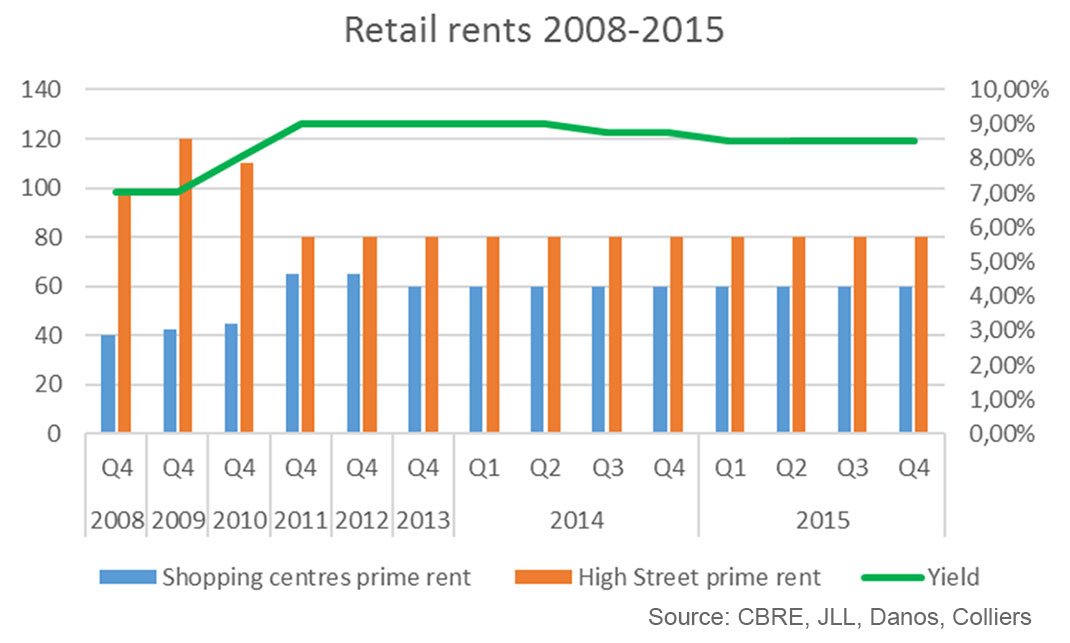

Central Belgrade retail rents saw a sharp decline from their peak of €120 per m2 per month in 2009 to about €80 per m2 per month in 2011 where remained steady since. On the other hand, the shopping malls prime rates went up from €40 per m2 per month in 2008 to €65 per m2 per month in 2011 before stabilising to the level of €60 per m2 per month where they are today. In that period, the retail GLA was increased by about new 300,000 m2 in Belgrade alone. The yields were at their peak of 9% in the period 2011-2014 but stabilised 8.50% at Q1 2015.

Sources of real estate finance today

Real estate is an alternative investment asset class which offers investors diversification and higher returns than the traditional assets such as shares and bonds. As it can be seen from the tables and graphs above, it also offers low correlation with traditional asset classes during financial crisis. Rents and returns from the commercial real estate in Serbia were steady from 2012 with very little volatility. As of late, some investors were able to exit their investments successfully (sale of shopping Kragujevac Plaza shopping mall by Plaza Centres to NEPI RE fund, which is investing further €60 million in another shopping mall in Novi Sad, Atterbury Europe has entered into a €259 million JV with the local MPC Properties to acquire 33% interest in Usce Shopping Mall, Hyprop Investments has acquired Delta Shopping malls in Belgrade and Podgorica).

Debt market

The only source of debt finance are banks, local banks or European banks with local branches. EBRD also participates in real estate market in various ways. The Banking Sector still suffers from a hangover caused by a large number of NPLs, 23.7% of which is attributed to landing for real estate development. Loan defaults occurred by both real estate developers and mortgage borrowers. Sale of distressed assets is likely to keep the prices subdued for some time. As a part of Vienna Initiative 2.0, the Government is trying to resolve the issue of NPLs by gradually allowing banks to sell distressed loans and assets.

Because of the fierce competition among banks, the good news is the interest rates have been coming down continuously since September 2013. At the end of 2015 the local currency investment loans were priced 6.1%, interest rates on Euro indexed loans were 4.4%. Needless to say, banks are assessing risks of every project before financing and set up the interest rates accordingly.

Because of the losses from the real estate sector and tiny margins they face in the future, the local banks have adopted conservative lending policy and are very selective which project they will finance. In order to mitigate their risks, among other requests, the future borrower needs fulfil the following criteria:

- Sizable equity participation (70:30 LTC or similar),

- Substantial pre-sales for residential developments or signed leasing contracts for commercial property),

- Excellent business plan with clearly defined project risks, cash flow models and risk assessment and mitigation,

- Reputation and experience of the developer,

- Reputation, experience, technical and financial capabilities of the main contractor (for developments).

All developers and property investors must finance their RE developments with a maximum amount of bank loans simply because it is the cheapest source of finance and consequently enables better returns on invested equity capital. For the local developers, accessibility and price of this source of finance mainly depends on two factors:

- Their ability to attract other sources of finance such as private equity or mezzanine and

- Preparation of adequate business plan to the bank or equity or mezzanine investors.

Local developers teaming up with PERE funds

Private equity real estate funds have been active in Serbia for quite some time now, attracted by high early entry returns and expansion possibilities. As we saw above, some also successfully exited their investments. Such early investors acted as developers in all types of real estate assets – Blue House Capital invested in Blue Centre office complex, AFI Europe invested in Airport City office complex, lately in a JV with another Israeli investor Shikun&Benui in the residential complex Central Garden, GTC International Group invested in several office and residential projects etc.

Feeling squeezed, the local developers have every intention to catch up with the competition by teaming up with real estate funds who are looking to combine their expertise and financial strength with the local expertise, experience and presence in Serbia. After all, real estate is a local business. Opportunities exists in both residential and commercial property development for developments from €20-180 million and with attractive returns.

Mezzanine finance

Mezzanine has been used in Serbia for corporate or acquisition finance so far. In real estate it would be preferential source of finance to equity because it does not water down developer’s equity.

Mezzanine for residential developments

- Shorter repayment periods 12-36 months with possible extensions of 12-24 months

- Structured as subordinated debt to senior lenders

- Non-recourse financial instrument

- LTC (loan to cost) 60-80% or LTV (loan to value) 5-10% less than LTC

Mezzanine for commercial properties

- Long repayment period, 7-10 years or on exit by the developer

- Acting more as equity capital structured as debt (because of the tax shield)

- Fund manager to have closer supervision over the investment

- Non-recourse financial instrument

- LTV 70-80%.

Investment in real estate as wealth preservation

Another untapped potential source for real estate finance are local bank savings. The local depositors keep in the banks €8.726 billion Euros earning negligible return. The volume of bank deposits has been growing by €561 million per annum since 2008, despite the financial crisis. About 13.4% or € 1.165 billion of all deposits are time deposits for various periods up to 5 years. Since investment cycles in real estate development projects seldom exceeds 5 years, there is a time match between time deposits of Serbian savers and real estate projects.

Real estate developers and investors should try to tap into this potential source of funding, through direct investment, issuance of debt or equity investment instruments or through institution forms of polled investments. If only 10% of the site deposits are attracted for investment in real estate, that may provide developers with €110 million addition equity finance, which, when leveraged with debt, can provide investment power of €400-500 million. Over the past 30 years people in Serbian have seen banks collapsing, private saving schemes turning to Ponzi schemes, companies going bankruptcy etc all taking their savings away in smoke. Real estate was the only asset class that has preserved and enhanced individual wealth on long term. If sound projects and appropriate returns that match risks are offered to them, we believe a substantial chunk of the time deposits sitting idle in the banks could be attracted into real estate finance.

Reference list for the information used in the article:

- Real estate market report produced by real estate agencies Danos, CBRE, JLL and Colliers for the period 2008-2015

- National Bank of Serbia, Annual report for 2014 and various quarterly and other reports

- National Corporation for mortgage underwriting – NKOSK

- Serbia Investment and Export Promotion Agency-SIEPA

- SEECAP research and database

©SEECAP Consulting, April 2016